How To Save Tax In India?

Tanish Goswami -

Jan 24, 2023

Tanish Goswami -

Jan 24, 2023

We often put money into various things that make our lives better, but can also put a lot of stress on our finances. The government offers assistance in the form of income tax exemptions for direct taxes assessed on your total salary to significantly lessen this burden.

1. Engage in Investments :

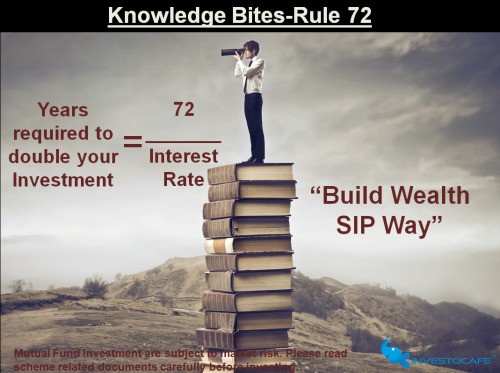

Higher returns and tax-saving opportunities can result from capital market and government-mandated investment strategies.

By investing in various instruments, you can learn how to reduce income tax in India under Section 80C. ELSS (Equity Linked Savings Scheme) or tax-saver mutual funds stand head and shoulders above the competition due to their low assumed risk and potential for wealth creation. This tool has a lock-in period of three years, and up to 1.5 million dollars can be invested without paying taxes.

Additionally, profits realized are exempt from taxation if their total capital gains are less than Rs. 1 lakh.

2. Apply for a Home Loan and Take Advantage of Section 80C Tax Benefits :

A home loan has two advantages, it reduces your tax burden and gives you the satisfaction of owning your own home. Section 80C allows for deductions of up to 1.5 Lakh from total annual income used to pay back the principal borrowed. Section 24(b) allows for tax exemption on the interest portion of the home loan, up to 2 Lakh per year.

Additionally, the entire interest component is exempt from annual income tax calculations if the newly acquired property is rented out. Section 24(b) also applies to people who buy a property to build a house, as long as the building process is finished in five years.

Under Section 80EEA*, you can claim an additional reduction in your annual tax liability if this is your first home. If the property's stamp duty value is less than 45 lakh, you can claim a total waiver of up to 1.5 lakh in addition to Section 24(B). Limited time period

3. Purchase a Health Insurance Policy :

In India, health insurance is becoming increasingly necessary due to rising medical costs and declining health quality as a result of numerous factors. When a person's health deteriorates, these insurance policies ease the financial burden on them and their families.

The government offers tax breaks to encourage people to buy these insurance policies, which allow them to get high-quality care at top hospitals or clinics at low or no additional cost.

4. Invest Your Money in Government Schemes :

Numerous government-mandated schemes provide tax breaks in addition to high total investment returns. Under Section 80C of the Income Tax Act, individuals are entitled to tax exemptions on their total annual income for investments of up to 1.5 million.

Investing in the following tools can get you tax breaks:

• Public Provident Fund (PPF)

• National Pension Scheme (NPS)

• Senior Citizen Savings Scheme (SCSS)

• Sukanya Samriddhi Yojana (SSY)

• National Pension Scheme (NPS)

5. Consider Life Insurance Plans :

Premium payments and payouts at maturity on life insurance policies are exempt from taxation.

Sections 80C and 10D of the Income Tax Act deal with premium payments and the sum assured received upon maturity or the insured's premature death, whichever comes first.

However, if the policy was purchased after January 1, 2012, tax benefits of up to 1.5 million can be claimed under Section 80C, provided that the annual premium is less than ten percent of the total amount insured.

If the policy was taken out prior to April 1, 2012, claims under Section 80C can be made as long as the total amount paid for premiums does not exceed 20% of the amount insured.

If the sum assured realized on these life insurance policies complies with the aforementioned guidelines, it is also exempt from tax calculations under Section 10(10D).

Under Section 80CCC, life insurance coverage can be purchased or renewed, and annuity payments made out of yearly salary are also eligible for tax breaks of up to 1.5 lakh.

Only certain pension funds covered by section 23AAB are eligible for waivers of up to 1.5 million under section 80CCD(1). Long-term capital gains (LTCG) taxes are not levied on the portion of an investment that is invested in the stock market.

6. Claim house rent exemption :

You can claim tax exemptions for the house rent allowance (HRA) under Section 10(13A). To receive compensation for the HRA, your salary breakdown must include one.

However, the minimum value of three components is used to determine the total tax exemption on rent paid:

• HRA received annually

• 50% of the individual's annual salary in metropolitan areas (40 percent in non-metro areas).

• 10% of the basic salary is the total annual rent.

Under Section 80GG, you can claim tax benefits on annual rental costs if your monthly income does not include the HRA component. The minimum value of the following requirements is used to determine the total amount of income tax deductions: • A monthly rent payment of up to 5,000 yen

• 25% of the total gross income

• The total rent less 10% of the base salary

As a result, if you keep the aforementioned considerations in mind, you can learn how to save tax in India on salary through house rent allowance.

7. Donate to a Charity :

Under Section 80G of the Income Tax Act, cash donations to specific organizations are eligible for a 2,000 tax exemption. On the other hand, wire transfers and bank transfers are exempt from paying taxes in full or in part, respectively.

Under Section 80GGA, you can claim deductions for donations to organizations that support rural development or scientific research.

Donations made in cash are exempt from paying taxes in part, but transfers made by check or draft are exempt from all taxes.

8. Donate to a political party :

According to Section 80GGC of the Act of 1961, all contributions to electoral trusts and donations to political parties are eligible for tax exemptions.

If the organization is registered under Section 29A of the Representation of People Act of 1951, your entire donation is exempt from income tax calculations.

These donations cannot be made in cash; they must be made by wire or bank transfer.

A Few Other Options for Saving Taxes in India All the aforementioned strategies will provide a comprehensive idea of how to save tax in India. Other considerations to keep in mind when looking for tax-saving strategies include the following:

• Education loans' interest payments are exempt from taxation under Section 80E. However, only the first eight years of loan repayment are eligible for these benefits.

• Under Section 80DDB, individuals' medical treatment expenses are exempt from tax calculations. For certain diseases, medical bills of up to 40,000 can be submitted for tax exemption. Seniors and super-seniors receive an additional benefit of one lakh rupees. However, only neurological disorders, cancer, AIDS, renal failure, and hematological disorders are covered by treatment costs.

• Under Section 80DD, if you host a dependent family member with a permanent disability, you can claim a tax exemption on all costs incurred to support that person's lifestyle. In a similar vein, members of a HUF who are disabled may claim tax exemption.

• Individuals with disabilities of 40 percent or more may file for reimbursement of up to 75,000 yen, while those with disabilities of 80 percent or more are exempt from reimbursement for up to 1,25,000 yen.

All of these things will help you learn more about the various government-mandated provisions and reduce your total taxable income for a specific fiscal year. To receive subsequent proceeds, you must submit the income tax return form and Form 16 provided by your employer.

To get in touch please visit us at investocafe.com