WHY START A SIP (Systematic Investment Plan)

Team Investocafe -

Sep 04, 2018

Team Investocafe -

Sep 04, 2018

In today’s world where life is busy and hectic with plethora of tasks including personal & professional, managing one’s personal finance management is quiet an important one which people take very lightly and keep procrastinating. The best way to create good wealth or reach your financial goal in terms of simplicity, discipline, affordability and benefits is SIP (Systematic Investment Plan). Have you ever wondered what is so special about SIPs? Just think over the following few reasons before considering SIP as a way to create wealth or financial freedom.

Simplicity & Discipline

If you calculate on a SIP calculator (https://www.investocafe.com/sipCalculation), you would know that it simply tells how small amount can be a wealth creator in a long term scenario. The simplicity of SIP is that it is easily affordable and entails discipline in investments.

Many investors are on a start and stop mode of investing. They start investing when there is optimistic mood all around them and they stop their investment when there is pessimism (volatility in market) around them. SIP puts an end to this dubious practice by instilling financial discipline in investors. It forces investors to invest a fixed sum of money regularly irrespective of the market conditions. Since the money is directly debited from your bank account, the chances of you missing your investment or market conditions influencing your decision come down. You can also set up the SIP date right after your salary date to ensure that you do not spend money before investing. It is almost impossible to create a large corpus unless you invest a small amount regularly over a long period.

For example, you simply can’t create a retirement corpus of Rs 1 crore on the day of your retirement. Creating such a large corpus would definitely require you to set aside a fixed amount every month over a long period. SIP helps you to do it easily.

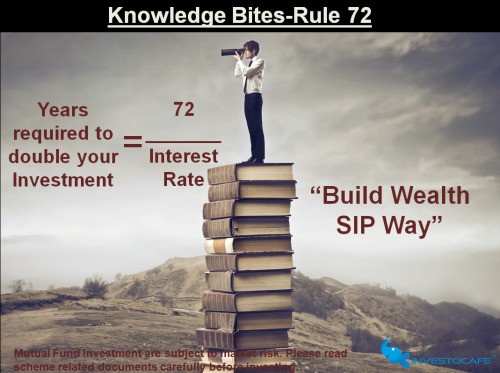

Reap the Power of Compounding

Compounding is about earning interest by reinvesting the interest earned. The magic of compounding can turn a small amount invested regularly into a very large corpus. Investment experts say that it is always better to start investing early with a small amount than waiting for a large sum to start investments.

Suppose you start investing Rs 4,000 every month in an equity mutual fund to meet a retirement goal that is 25 years away and if your investment generates 14 per cent returns (which is an average return of mutual funds), at the end of the SIP tenure, you can expect to have Rs. 1,09,09,111.

Averaging

Stock market is known for its volatility. Investors usually try to circumvent the problem by timing the market: purchasing when the market is down and selling during the peak. But timing is not an easy thing to practice.

You can never be sure whether the market has hit the bottom or it won’t fall further. Or, the price won’t rise further. The only way to handle such uncertainty is to average out your purchase cost over a period of time.

Suppose an investor were to invest Rs 1,000 per month for 6 months. If, in the first month, the NAV is Rs10, the investor will be allotted Rs 1,000 ÷ Rs 10 i.e. 100 units. In the second month, if the NAV has gone up to Rs 12, the allotment of units will go down to Rs 1,000 ÷ Rs 12 i.e. 83.333 units. If the NAV goes down to Rs 9 in the following month, the unit-holder will be allotted a higher number of Rs 1,000 ÷ Rs 9 i.e. 111.111 units. Thus, the investor acquires his Units at lower than the average of the NAV on the 6 transaction dates during the 6 month period – a reason why this approach is also called Rupee Cost Averaging. Through SIP an investor does not end up in the unfortunate position of acquiring all the units in a market peak

In view of the above points, the verdict is very clear to go ahead with SIPs for wealth creation & long term financial goals, which would ultimately contribute to your financial freedom and overall financial health. For more details visit https://www.investocafe.com

To get in touch please visit us at investocafe.com