Stocks vs Mutual Fund

Neha Joshi -

Aug 01, 2018

Neha Joshi -

Aug 01, 2018

What’s Better? Investing in Equity Mutual Fundsor Directly in Stocks

Equities have out-performed other investment asset classes over the long-term in India as well as globally. With growing maturity, retail Investors in India have begun to realise this and also take into stride the short-term volatility of this asset class. Better regulatory environment and improved corporate governance have also helped bring more investors to Equities.

Currently, retail equity investment in India is mostly channeled directly in stocks. Individual investors hold around 20% of the total equity market value, while mutual funds account for about 3%. This is almost the opposite of global trends where retail money is mostly professionally managed and mutual funds are the investment vehicle of choice for equities.

Equity mutual funds in India have been relatively consistent in outperforming the broader stock market.

Five Difference between stock & mutual funds investing.

When we say Equity, what comes to your mind –Stock or Equity Mutual Fund? While a single stock or a mutual fund both comes under the category of Equity and they are good option for long-term investment and needs periodic review. There are some differences between stock investing and mutual fund investing that is done by a common man. It’s a good idea to know where they differ and in which situation they differ, so that one can take better investing decisions. Let’s look at the main differences.

Volatility:

When you invest in a single stock or bunch of stocks (3-5 scrips), the change in it’s value is very high. On a given day it can be extremely volatile. It can give you 20% return and sometimes -10% loss also depending on the environment.This can be very exciting and at the same time very disheartening and gives you a feeling that you need to “act fast”.

Mutual fund on the other hand is not that much volatile by nature, as the diversification is very large and at a time 50-100 stocks are covered. Different kinds of stocks from different sectors and market capitalization are involved in mutual fund and the over all change in value is thus less volatile (other than extreme days).

Return Potential:

This is very much in line with the above point but still let’s look at it separately. There are lot of success stories where someone got quick rich by investing in equities directly and it can happen, but those are rare happenings and require lot of work and analysis, patience and belief in what you have picked. If you want superb returns in short time and you believe you can research well, you can go for stock investing directly but then risk is also more.

Mutual funds are known to deliver good returns(not in line with stocks, but still very good). So you can expect handsome returns from mutual funds but not unbelievable like stocks return. This is mainly because the money is diversified across different stocks (read ideas)and chances of all of them becoming a super success in short time is impossible.

Monitoring Required:

Stock investing is a personal affair and you are doing it on your own the decision of what to sell and what to buy is on you. Even in case of long-term investing, you might have to keep an eye every quarter or yearly unless you have really spent some good time in picking the good stock. You need to also keep an eye on news and sector specific developments.

Monitoring in mutual funds is relatively low because the job of monitoring is anyways done by the fund manager who is paid SALARY to filter through the fluctuations. He constantly adds and removes the stocks from the portfolio. This can be a positive point, but sometimes it can be a negative point also if there is too much of churning.

SIP Investment:

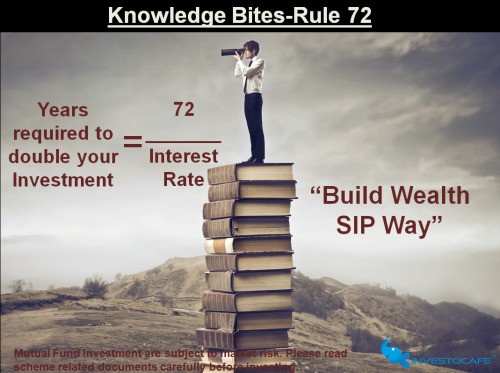

Mutual funds are known for possibility of SIP (monthly investment). SIP in mutual fund works and is recommended as a great way for a salaried person to invest in equity markets for long-term basis without understanding the working of equity markets.

However SIP in stocks do not work. Yes, some companies provide you the facility of SIP in stocks, but it’s a terrible concept. There is no diversification and SIP in a particular stock does not make sense because the risk is with single stock. A stock can be in a bad phase for years and decades, whereas in a mutual fund the bad performing stock is weeded out.

Asset Class Restriction:

Stocks investing is restricted to Stocks only. You can choose a large cap stock, mid cap stock or small cap stock, but finally it will be equity asset class. However, mutual funds can invest in mix of asset classes. There are equity funds, debt funds, gold funds, Mix of Equity and debt also. To top up, even balanced funds are there which can adjust the asset allocation on its own, so in a way mutual funds are more superior in terms of features compared to a single or bunch or stocks.

Conclusion

Mutual Funds are actually collection of stocks only but just because it’s a group of stocks but the characteristics are not very similar to that of stocks. You should be clear about all the points of difference and only after that you should decide whether to invest in Stocks directly or take the convenient way i.e. Mutual Fund route.

“It takes less effort, less time, less experience and less specialized knowledge to get good returns from equity mutual funds than it does from directly trading in equities”

Written By: Neha Joshi, AMFI Certified

Investocafe: Head-IT Infrastructure

To get in touch please visit us at investocafe.com